(1)Evolution in Chinese yuan Exchange Rate Regime

① 1949 1972 Peg to the U.S.Dollar

After liberalization,Chinese economy was in urgent need of restore.Foreign exchange resources were scarce and the authority enforced control on foreign exchange by a series of reforms.The exchange rate was officially determined.Chinese Yuan was pegged to the U.S.dollar.

② 1973 1985 Peg to a Basket of Currencies

China has gone through currencies and weights adjustments 7 times,and Chinese Yuan was then officially converted into a basket of currencies.

In 1985,only official rate published by the State Administration for Exchange Control prevailed.

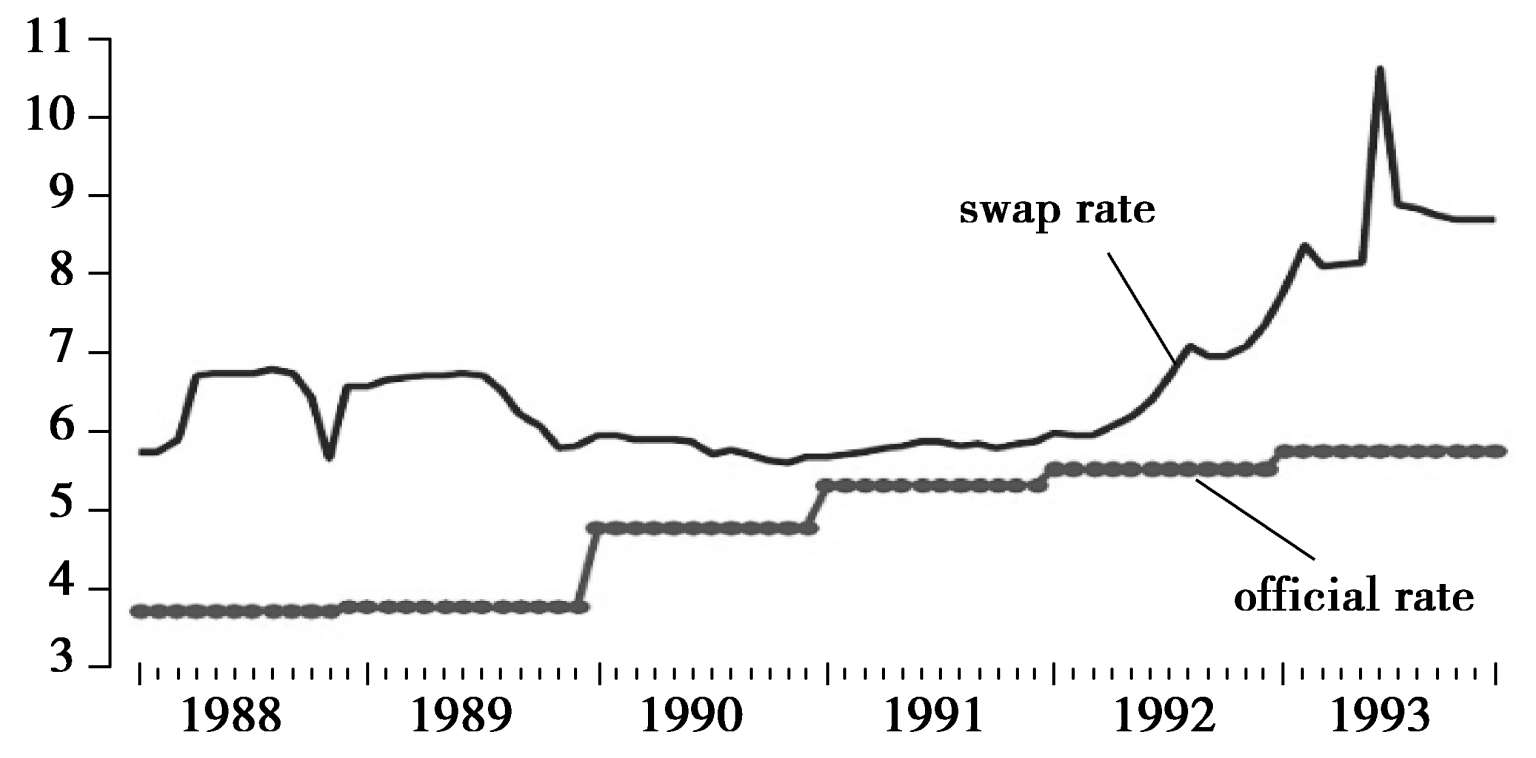

In 1986,a swap center was established to associate exchange rate determination converting to managed floating.But the exchange rate determined in swap center went array from the official rate.As the gap between official rate and swap rate enlarged,China started to unify exchange rates.

③ 1994 2005 Market-Based Managed Floating Exchange Rate

On 1st Dec.1996,China accepted the obligations of Article VIII of the IMF Articles of Agreement on current account convertibility.After conditional current account convertibility was introduced,the exchange market was unified.

China adopted market-based managed floating exchange rate by setting up China Foreign Exchange Trading Center where inter-bank foreign exchange is traded.This center is electronically linked with major foreign exchange trading centers.

④ 2005 2010 Closing Rate against Major Currencies

Since 2005,China launched reforms on foreign exchange regime.The U.S.dollar is no long the only currency in Chinese Yuan exchange rate determination.On July 22,2005,China started to announce the Chinese Yuan closing rate against major currencies,the data is collected from the inter-bank foreign exchange market by the end of each trading day.

China then started direct trading between Chinese Yuan and other currencies

.

.

⑤ 2010 Present Chinese Yuan Internationalization

On 15th Dec.2010,the first overseas market of Chinese Yuan was established,the yuan started trading in Russia.

On 13th Jan.2011,qualified domestic enterprises were proved to invest in foreign countries directly using Chinese yuan.

On 1st Dec.2016,Chinese Yuan has been officially included in SDR basket.

(2)A Chronicle of Major Reform on Exchange Rate Formation Mechanism:2005 2015

◆ 21st Jul.2005:China initiated the reforms by de-pegging the yuan from the U.S.dollar.The PBOC said it had shifted to “a managed floating exchange rate based on market supply and demand with reference to a basket of weighted currencies.” The yuan against the U.S.dollar appreciated by 2% to 8.11 on that day.

◆ 22nd Jul.2005:The PBOC began announcing the yuan's closing rate against major currencies on the inter-bank foreign exchange market each trading day.

◆ 11th Jan.2007:The central parity rate of the yuan against the U.S.dollar topped 7.8.The yuan's value exceeded the Hong Kong dollar for the first time in 13 years.

◆ 21st May.2007:The yuan's value was allowed to rise or fall by 0.5% from the central parity rate each trading day,from a previous limit of 0.3%.

◆ 8th Apr.2009:Cross-border trade was allowed to be settled in the Chinese yuan on a trial basis in Shanghai and Guangdong Province.

◆ 21st Jul.2009:Four years since the exchange rate reform,the yuan against the U.S.dollar had appreciated by 21%.

◆ 19th Aug.2010:China started direct trading between the yuan and the Malaysian ringgit.

◆ 15th Sep.2010:The U.S.lawmakers at a Congress hearing pressured China to appreciate its currency.China's Foreign Ministry said the yuan's appreciation would not help the Sino-US trade deficit.

◆ 22nd Nov.2010:China started direct trading between the yuan and the Russian ruble on the inter-bank foreign exchange market.

◆ 15th Dec.2010:The yuan started trading in Russia,the first overseas market of the Chinese yuan.

◆ 13th Jan.2011:The PBOC allowed qualified domestic enterprises to invest in foreign countries directly using the yuan.

◆ 16th Apr.2012:The yuan's value was allowed to rise or fall by 1% from the central parity rate each trading day,from the previous limit of 0.5%.

◆ 1st Jun.2012:China started direct trading between the Chinese yuan and the Japanese yen on the inter-bank foreign exchange market.

◆ 9th Apr.2013:China started direct trading between the yuan and the Australian dollar on the inter-bank foreign exchange market.

◆ 17th Mar.2014:The yuan's value was allowed to rise or fall by 2% from the central parity rate each trading day,from the previous limit of 1%.

◆ 18th Mar.2014:China started direct trading between the yuan and the New Zealand dollar on the inter-bank foreign exchange market.

◆ 18th Jun.2014:China started direct trading between the yuan and the British pound on the inter-bank foreign exchange market.

◆ 30th Sep.2014:China started direct trading between the yuan and Euro on the inter-bank foreign exchange market.

◆ 27th Nov.2014:The vice PBOC governor at the time said the bank had “largely”withdrawn from intervention in daily foreign exchange business.

◆ 26th May.2015:David Lipton,first deputy managing director of the International Monetary Fund(IMF),said Chinese Yuan was no longer undervalued.

◆ 27th Jun.2015:The PBOC said it would continue to push ahead with reforms in the exchange rate formation mechanism.

◆ 11th Aug.2015:The PBOC said daily central parity quotes reported to the China Foreign Exchange Trade System before the market opens should be based on the closing rate of the inter-bank foreign exchange market on the previous day,supply and demand in the market,and price movement of major currencies.The central parity rate of the yuan against the U.S.dollar weakened sharply to 6.2298.

◆ 12th Aug.2015:The IMF described Tuesday's policy change as“a welcome step” that allows market forces to have a greater role in determining the exchange rate.The USDCNY rate declined to 6.3306.

(3)RMB(Chinese yuan)Internationalization

In order to lower exchange costs,facilitate use of the two currencies in trade settlement and boost bilateral investment,direct on shore trade is allowed in a number of currencies,including the Malaysian ringgit,Russian ruble,Japanese yen,Australian dollar,New Zealand dollar,British Pound,Euro,Singapore dollar,South Korean won,South African rand,the riyal of Saudi Arabia and the dirham of the United Arab.(Sep.2016)

RMB has passed the assessment on the use of RMB in commercial banks' liabilities,its share in global foreign exchange and derivatives transactions,its ranking in international reserves,RMB capital account convertibility and its proportion in the global bond market,then has been officially included in SDR basket on 1st Dec.,2016.

Since the handover of Hongkong in 1997,China has been expanding use of the yuan in Hong Kong—a process that will eventually cement the decline of the U.S.dollar as the primary international settlement currency.There is a long way for the Chinese yuan to replace the U.S.dollar as a global settlement currency for international trade.

① Chinese Yuan availability is limited;

② China's bond market,which central banks and international companies would access to borrow yuan for payment transactions,is small to facilitate global trade,compared to the U.S.bond market;

③ the Chinese banking system is not yet sophisticated enough to effectively manage the fund stream of a bond market of a depth,breadth and scale required for international trade;

④ the Chinese markets are not totally open to outside investors.

(4)Further Reforms for RMB Internationalization

More reforms are expected to be unveiled to accelerate the internationalization of the yuan,or the RMB.

The RMB's inclusion into the SDR basket came after a series of reforms,including the exchange rate formation mechanism and cross-border interbank payment.

After the IMF 's SDR inclusion of the RMB on 30th Nov.2015

The People's Bank of China(PBOC)approved RMB convertibility on the capital account within a prescribed limit of$10 million for the Tianjin,Guangdong and Fujian free trade zones on 11th Dec.2015,a historic step by China to open up its capital accounts.

China allowed RMB convertibility on the trade accounts nearly two decades ago,but almost all capital account transactions in the mainland remain under varying degrees of control.

On 11th Dec.2015,the central bank released the yuan exchange rate composite index measuring the currency's strength relative to a basket of other currencies to better reflect the market.

It helped bring about a shift in how the public and the market observe RMB exchange rate movements,as the CFETS exchange rate composite index measures the yuan's strength relative to a basket of 13 foreign currencies,including the U.S.dollar,Euro and Japanese yen,weighted according to their trade volume with China.

Compared with just one currency,a basket of currencies can better capture the competitiveness of a country's goods and services and better enable the exchange rate to adjust imports,exports,and investment activities and the balance of payments position.

However,valuing against a basket of currencies does not mean a peg to the basket.Market demand and supply will also play a key role in formulating the rate.

The establishment of the China-initiated Asian Infrastructure Investment Bank on 25th Dec.2015 in Beijing also helped the internationalization of the RMB,as it created more possibilities for the international use of the currency.

China will seek to optimize the interest rate transmission mechanism and exchange rate formation mechanism as well as improve transparency of monetary policies.

Updated:Aug 15,2016 7:16 AM

WASHINGTON(Xinhua)—China's authorities have largely succeeded in its objective of revamping the foreign exchange mechanism to make the currency RMB more market-oriented and relatively stable to a basket of currencies over the past year,thanks to improved policy communication,US experts have said.

On Aug 11,2015,the People's Bank of China(PBOC),the central bank,announced a major improvement to the formation of the RMB's central parity rate against the US dollar,by taking into consideration the closing rate on the inter-bank FX market of the previous day.

The move was described by the PBOC as a“one-time correction” to bridge previously accumulated differences between the central parity rate and the spot market rate,which would make the central parity rate more consistent with the needs of market development.

The central parity rate is the starting point for daily FX trading,and the RMB is allowed to rise or fall by 2 percent from the central parity rate each trading day from March 2014.

Think tank and the International Monetary Fund(IMF)experts agreed that the central bank's move was very much in the direction to increase the role of market forces in the determination of the RMB exchange rate.

But some market participants at that time misinterpreted it as an effort to prop up the economic growth by currency devaluation and incorrectly jumped to the conclusion that China's economy was probably worse than stated.The RMB fell sharply in value in the following days after the reform of the central parity system.

“I think initially when they started changing the system a year ago,they were not good at communication,and there was a lot of confusion in the market about what their intention was,”said David Dollar,a senior fellow with the Brookings Institution and former official of the World Bank and the US Treasury Department.

However,Chinese authorities provided “pretty good and clear communication” about its exchange rate policy over the next few weeks and months,Dollar said,citing authorities’arguments that they wanted to have more market forces involved and there was no need for large depreciation of the currency.

Chinese officials have also repeatedly said that China has no intention of devaluating the RMB to gain an advantage in global trade.China has successfully moved up the value chain into higher value-added products and its share of global exports continued to expand in recent years despite the significant appreciation of the RMB,according to Nicholas Lardy,a senior fellow at the Peterson Institute for International Economics and a leading expert on China's economy.

China's current account surplus was about 300 billion dollars last year,which was the largest in the world in absolute terms,indicating that China didn't need to devalue its currency to boost the economic growth,Lardy said.

“China has a large trade surplus,and it's a rapidly growing economy,there's not really the basis for depreciation,” echoed Dollar.

But capital outflows from China increased significantly in September and December as market participants expected that the US Federal Reserve would start raising interest rates by the end of the year and the dollar would rise more rapidly against other currencies.

On December 11,China introduced a RMB exchange rate composite index to help guide market participants to shift their focus from the bilateral RMB /USD exchange rate to the effective exchange rate based on a basket of currencies.

The new index,released by China Foreign Exchange Trade System(CFETS),is calculated by comparing RMB to the average value of the 13 foreign currencies,including the US dollar,EURO and Japanese yen,weighted according to the trade volume with China.

The PBOC noted that valuing against a basket of currencies does not mean a peg to the basket,but it “will contribute to maintaining the RMB exchange rate basically stable at an adaptive and equilibrium level.”

The PBOC also took several other steps,including selling FX reserves,implementing macro prudential regulations and strengthening checks on capital outflows,to help stabilize market expectations for the RMB exchange rate,according to Guan Tao,a senior fellow at the China Finance 40 Forum and former official at China's central bank.

But the large decline in China's FX reserves and rumors about tightening of capital control measures seemed to further fuel market expectations of a weakening RMB at the beginning of this year.China's FX reserves shrank by $512.7 billion in 2015,the largest annual decline on record.

“I think the argument that the decline in reserves is because of panic mainlanders trying to get their money offshore is somewhat misleading,” Lardy said.“I think it largely reflects actions of investors and corporations in response to change in exchange rate expectations and interest rate differentials.”

The Institute of International Finance(IIF),a global association representing about 500 financial institutions,also estimated that a large part of capital outflows from China last year were repayments of dollar-denominated debts by Chinese companies,in order to mitigate the impact of the dollar appreciation.

In an interview with Chinese magazine Caixin in February,Zhou Xiaochuan,governor of the PBOC,chose a critical moment to clarify China's exchange rate policy,as Chinese financial markets prepared to reopen after the week-long Lunar New Year holiday.

Zhou reiterated that China will “rely further on the market to decide the level of the currency and to achieve a more flexible foreign exchange rate”.He signaled that China will keep the RMB broadly stable versus a basket of currencies while allowing greater volatility against the dollar.

Zhou dismissed speculation that China plans to tighten capital controls and said there's no need to worry about a short-term decline in FX reserves.He reassured investors that there is no basis for the continued depreciation of the RMB and that China would not let market sentiment be dominated by speculative forces.

Zhou's comments helped ease the RMB's depreciation pressures and received praise from IMF chief Christine Lagarde.“We have been delighted to see the communication efforts undertaken by policymakers,particularly Governor Zhou,” Lagarde said in February,adding that it was“a good example of how communication can actually clear the uncertainties and trepidations.”

At the same month,the PBOC clarified that the central parity rate formation system would be based on the closing rate of the previous trading day and movements of a basket of currencies.Such exchange rate regime reflects a balance among market supply and demand,relative stability against a basket of currencies and stable market expectations,the central bank said.

Since then the RMB has seemed to enter a more stable period,as the Fed signaled slower pace of interest rate hikes this year and market participants gradually got used to two-way fluctuations of the RMB exchange rate.Speculators have also learnt that it's not wise to battle against the PBOC.

Charles Collyns,managing director and chief economist at the IIF,said China's central bank has been“much more successful” in currency management over the past six months,compared to the period from last August to this February.

“I think it finally convinced markets that it wanted to avoid an abrupt depreciation of the RMB once keeping market conditions broadly stable,” Collyns told Xinhua,adding that “it has also shown it's possible for the RMB to fluctuate in response to short-term shifts of market conditions without destabilizing markets”.

He hoped that China's central bank would keep good communication and let the exchange rate move in line with market conditions going forward,noting that the central bank could reduce the risk of instability “by communicating more openly with markets”.

“We learned a very important lesson about the importance of communication,” Dollar said,believing that Chinese authorities have“largely succeeded” in their objective of the marketoriented exchange rate reform over the past year with improved communication.

“The currency has been relatively stable.It has appreciated a little bit against the basket,but not very much,and then depreciated a little bit more against the dollar,because the dollar has been strengthening against other currencies,” he said.

“The RMB remains broadly in line with fundamentals,” the IMF said in a report after concluding its annual economic health check on the Chinese economy,expecting the volume of capital outflows from China to moderate this year.

“The large outflow seen in 2015:Q3 2016:Q1 will gradually moderate as the pressure from external debt repayment peters out.The secular trend of residents’acquisition of foreign assets to balance their investment portfolio is expected to continue,but not materially accelerate from current levels.” the report said.

The IMF welcomed China's steps toward an effectively floating exchange rate regime and supported a cautious approach to capital account liberalization“that is carefully sequenced with the progress on exchange rate flexibility and financial sector reforms”.

The IMF last year approved the inclusion of the RMB into its Special Drawing Rights(SDR)basket as a fifth currency,along with the US dollar,EURO,the Japanese yen and the British pound,marking a milestone in the RMB global march.The new SDR basket will be effective from Oct 1,2016.

Dollar said China has done financial reforms needed for the RMB to be officially included into the new SDR basket.He encouraged China to move ahead with structural reforms in the real economy,dealing with excessive capacity,zombie firms and bad debts,which would make China's financial system more robust and underpin the RMB's reserve currency status.