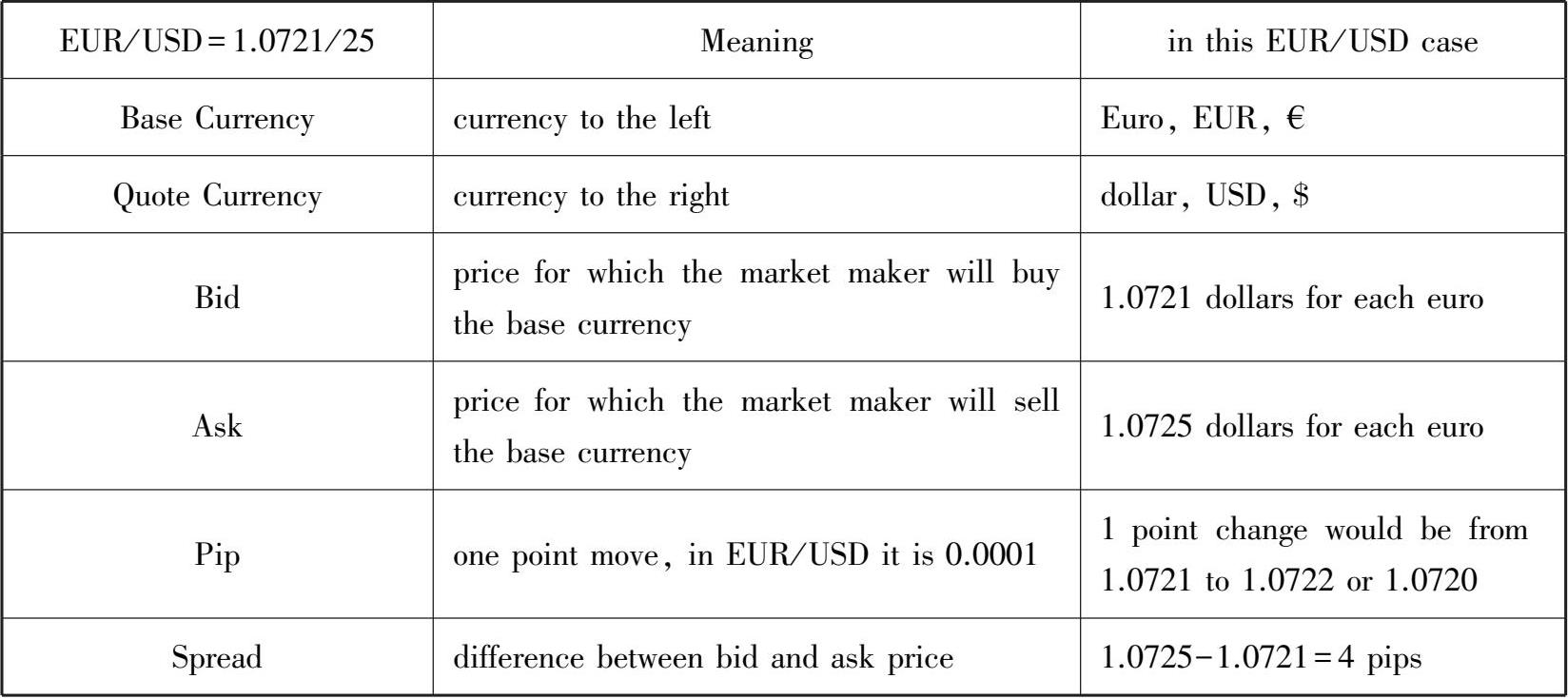

Market makers in FX market offer buying and selling rate on the same currency pair.A full quotation,sometimes called “two way quotation”,is made up of 2 prices:the buying rate “bid”and the selling rate “ask”(or offer).Market makers quote to their advantage and to their trading party's disadvantage.For example,one bank,as a market maker,usually offers exchange rate as EUR/USD=1.3261 /63,where the bid price,1.3261,is the dollar price(in quote currency)this bank offers to buy one unit of the base currency Euro;the ask price,1.3263,is the price(in quote currency)this bank requires to sell one unit of the base currency.The quote before the slash,1.3261,is the bid price,and the two digits after the slash represent the ask price(only the last two digits of the full price are typically quoted).A quote on USD/JPY of 89.89 /90.00,for example,is said to be 11 pips wide(ask 90.00-bid 89.89).Because market makers buy with low price and sell with higher price,the bid price is always smaller than the ask price(bid low,ask high).

In practice,exchange rates are usually quoted only the last two numbers for simplicity.It is presumed that anyone trading in FX already knows the big figure(the first 3 figures in the quotation).For example,instead of EUR/USD=1.2329 /31,the market maker would quote“29 /31” assuming the other party knows the rest of the price 1.23(in this case,1.23 is called“the big figure”).In an example of GBP /USD being quoted 1.4298-1.4301,the big figure are 1.42 and 1.43.The market maker would say:“98-01,around 1.43.” If the GBP /USD bid is given as 1.8493 and the ask is 1.8502,the dealer would say:“93-02,around 1.85”.

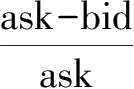

The difference between bid and ask is referred to as the “spread”.The spread(the transaction cost)is essentially the profit of FX market makers.The wider the spread the more expensive to trade.

Midpoint is ofter used for academic analysis.Midpoint=spread÷2=(ask-bid)÷2.

In general,bid and ask quotation could be summarized as the following example in Table 3-4.

Table 3-4 Quotation

Suppose that dealer A in New York offers GBP /USD=1.4034 to buy British pounds,while dealer B in London sells British pounds at GBP /USD=1.4032.An investor with no initial capital could realize a risk free profit from their offers.This dealer could borrow

1 from A,and sell this

1 from A,and sell this

1 to A for$1.4034;then sell$1.4034 to B,for

1 to A for$1.4034;then sell$1.4034 to B,for

1.4034 /1.4032,in the end repay 1

1.4034 /1.4032,in the end repay 1

to A,gaining a positive profit

to A,gaining a positive profit

(1.4034 /1.4032-1).

(1.4034 /1.4032-1).

Or,she could borrow$1 from B,and exchange this$1 with B for

1 /1.4032;then exchange

1 /1.4032;then exchange

1 /1.4032 with A for $1.4034 /1.4032,and repay $1 to B,gaining a positive profit$(1.4034 /1.4032-1).

1 /1.4032 with A for $1.4034 /1.4032,and repay $1 to B,gaining a positive profit$(1.4034 /1.4032-1).

Both ways provide a positive rate of return 0.02%.

But the arbitrage activities would compel both A and B to adjust the exchange rates so that this profitable opportunity could not last long.

Any offers showing a negative spread,(that is one seller's ask price is lower than another buyer's bid price),a 2-currency arbitrage arises.

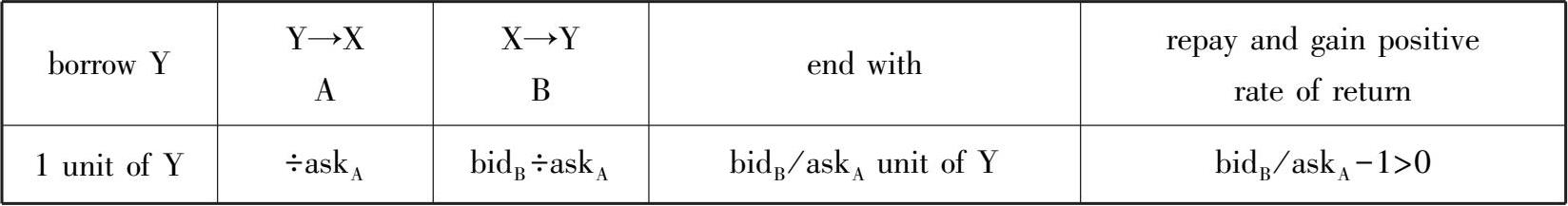

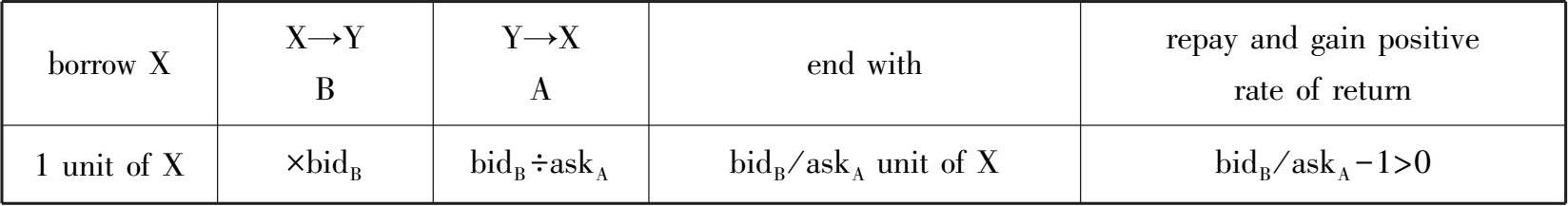

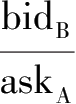

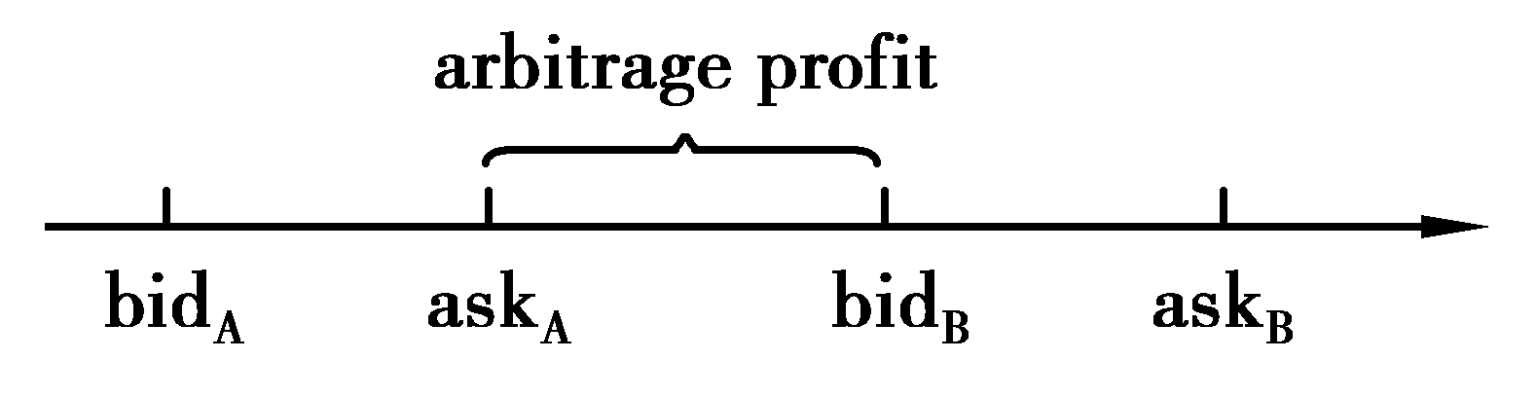

More generally,for currency pair X/Y,Bank A offers bid A /ask A ,Bank B offers bid B /ask B .If ask A <bid B ,one can first borrow currency Y and exchange Y with A for X(long X),secondly exchange X with B for Y(short X),and in the end she could repay Y gaining(bid B /ask A -1)Y as profit.

Or first borrow currency X and exchange X with B for Y(short X),secondly exchange Y with A for X(long X),and in the end she could repay X gaining(bid B /ask A -1)X as profit.

Both arbitrages provide the same positive rate of return.

-1 as demenstrated in the following figure.

-1 as demenstrated in the following figure.

Two currency arbitrage occurs on occasion when there is high volatility or thin liquidity.It has become more rare in recent years due to high-frequency trading,where computer algorithms have made pricing more efficient and reduced the time windows for such trading to occur.

As technology improved,arbitrage is rarely possible because when such opportunities arise,trades that take advantage of the imperfections are executed immediately and prices adjust up or down until the opportunity disappears.The low risk profit-seeking motive pushes exchange rates into alignment with each other.The arbitrage opportunities thus rarely exist or are rarely exploitable for two primary reasons:

① Arbitrage trading kills arbitrage opportunities;

② The arbitrage profit in buying low and selling high can hardly cover commission fee.

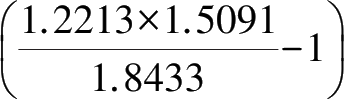

The triangular arbitrage case in Section 2.4 disappears,given the bid and ask prices as GBP /USD=1.8404 /33,GBP /EUR=1.5091 /105,EUR/USD=1.2213 /29.With the same strategy,a trader first borrows one million dollars from Citibank,when exchanges dollars for pounds with Barclays bank,she should spend 1.8433 dollars for each pounds;then she sells pounds to Dresdner bank for Euros,with the price of 1.5091 Euro for each pound;at last,the price she can get for dollar is 1.2213 dollars each Euro.When bid-ask spread is considered,the previous strategy turned out to be a loss:

1000000×

≈-236.17 dollars.

≈-236.17 dollars.

No profit can be achieved in the other 2 strategies.

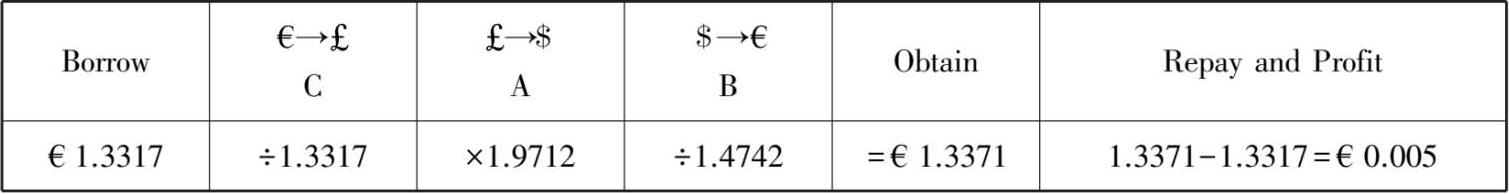

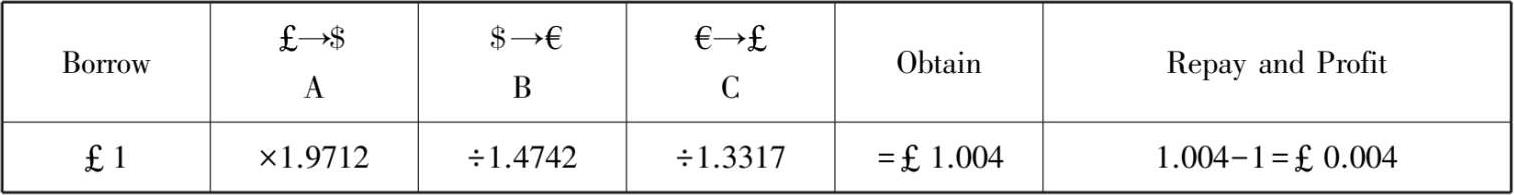

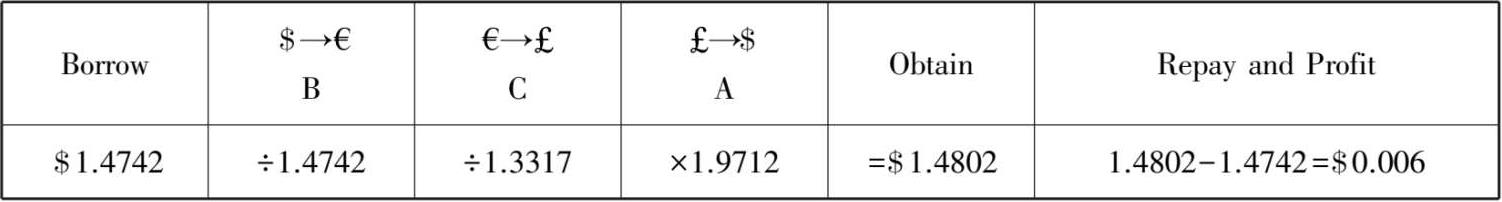

Is there any arbitrage opportunity if banks(A,B,and C)provide the following exchange rates.

A:GBP /USD=1.9712 /17

B:EUR/USD=1.4738 /42

C:GBP /EUR=1.3310 /17

The arbitrage opportunity can be realized by longing pounds from C for

1.3317 and shorting those pounds for

1.3317 and shorting those pounds for

1.3371,then go through A and B:

1.3371,then go through A and B:

or borrow some pounds and exchange for dollar from A,then go through B and C:

or borrow dollar and exchange for Euro from B,then go through C to A:

The following senario provides another triangular arbitrage example.

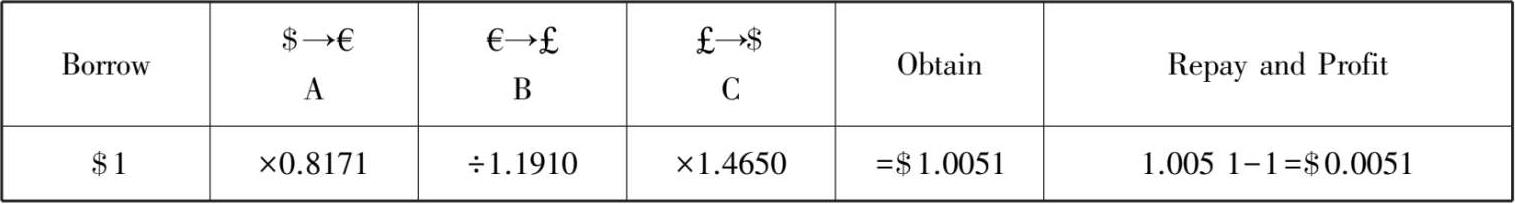

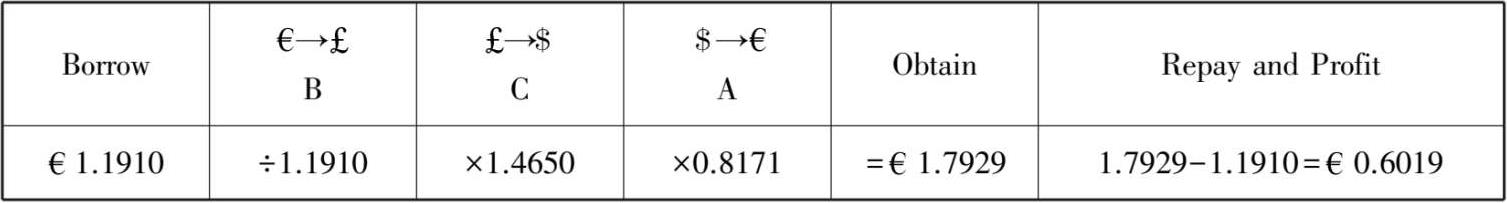

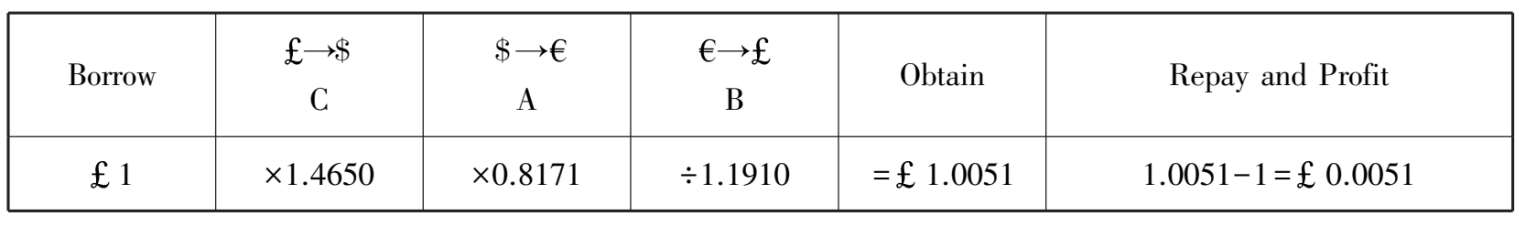

Investors can exploit risk free profits with no initial investment if three banks(A,B,and C)provide the following exchange rates.

A:USD/EUR=0.8171 /75

B:EUR/GBP=1.1906 /10

C:USD/GBP=1.4650 /56

One can catch triangular arbitrage by

or

or

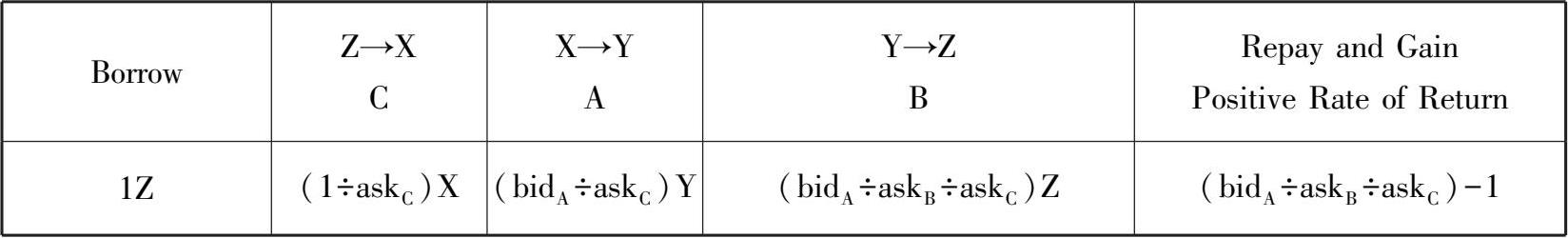

If ask B ×ask C <bid A ,the arbitrage transactions should use 3 prices:ask B ,ask C ,and bid A .More specifically,to make a triangular arbitrage one investor need a portfolio composed of two long positions(use ask B and ask C )and one short position(use bid A ):

Borrow Z:from C

long X

long X

long Y(bid

A

)

long Y(bid

A

)

long Z

long Z

repay and profit.

repay and profit.

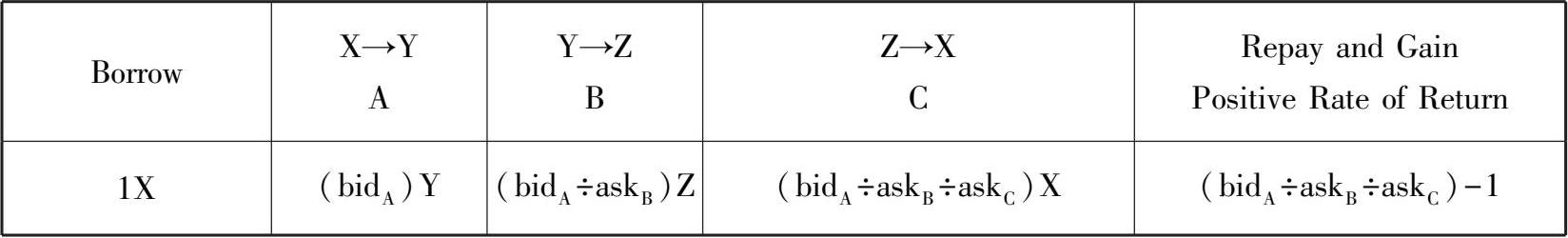

Borrow X:from A

long Y(bid

A

)

long Y(bid

A

)

long Z

long Z

long X

long X

repay and profit.

repay and profit.

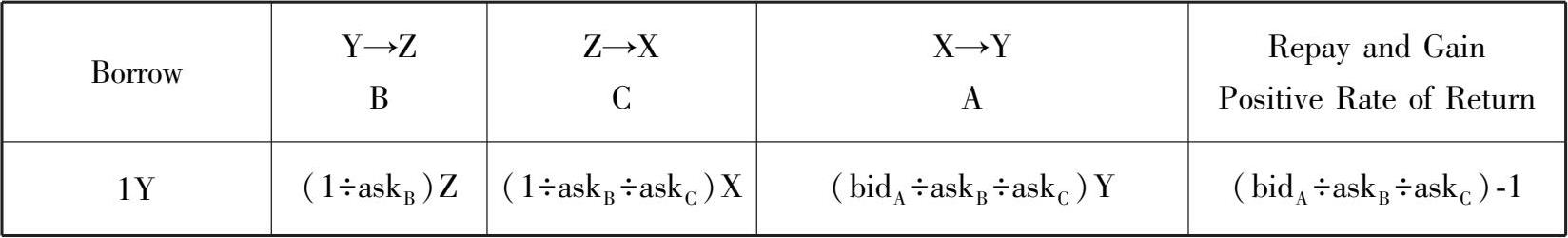

Borrow Y:from B

long Z

long Z

long X

long X

long Y(bid

A

)

long Y(bid

A

)

repay and profit.

repay and profit.

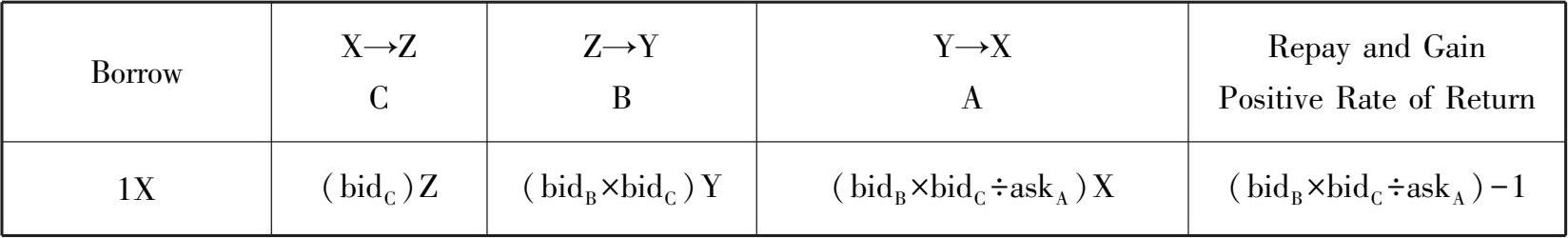

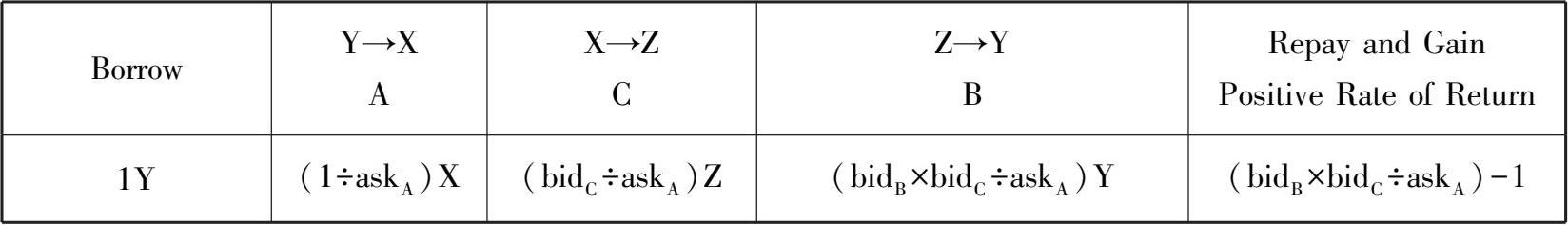

If bid B ×bid C >ask A ,the arbitrage transactions should use 3 prices:bid B ,bid C ,and ask A .More specifically,to make a triangular arbitrage one investor needs a portfolio composed of two short positions(use bid B and bid C )and one long position(use ask A ):

Borrow X:from C⇒short X

short Z

short Z

short Y(ask

A

)

short Y(ask

A

)

repay and profit.

repay and profit.

Borrow Y:from A

short Y(ask

A

)

short Y(ask

A

)

short X

short X

short Z

short Z

repay and profit.

repay and profit.

Borrow Z:from B

short Z

short Z

short Y(ask

A

)

short Y(ask

A

)

short X

short X

repay and profit.

repay and profit.

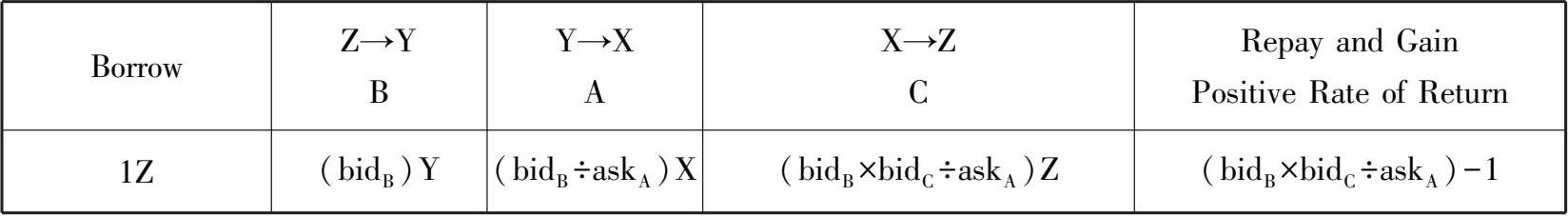

Figure 3-5 gives the rule of thumb:It does not matter which bank offers which currency pair,as long as one bank's bid is greater than the product of the other two banks' ask(clockwise trade)or one bank's ask is less than the product of the other two banks' bid(anti-clockwise trade).

Figure 3-5 Triangular Arbitrage Rule

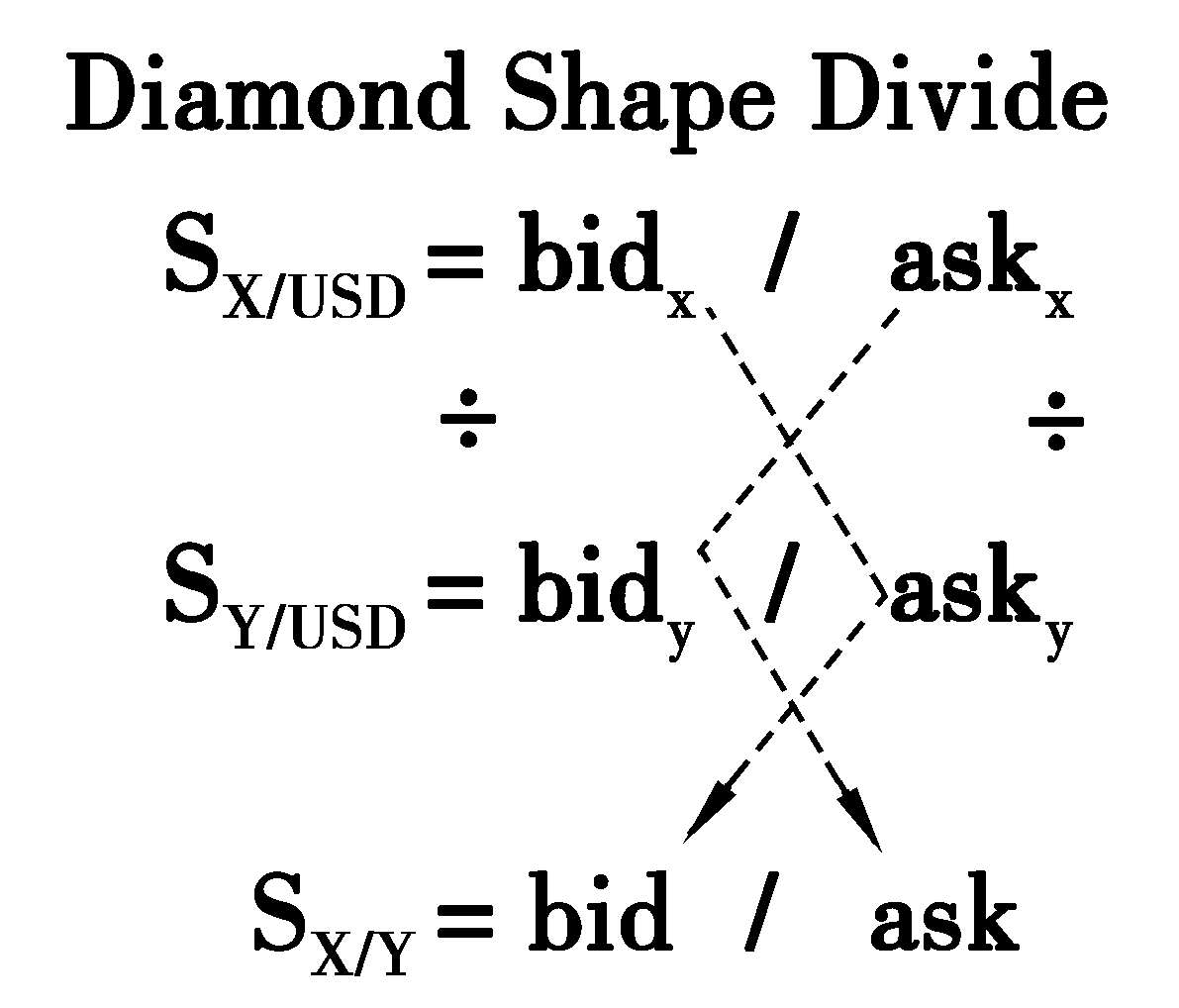

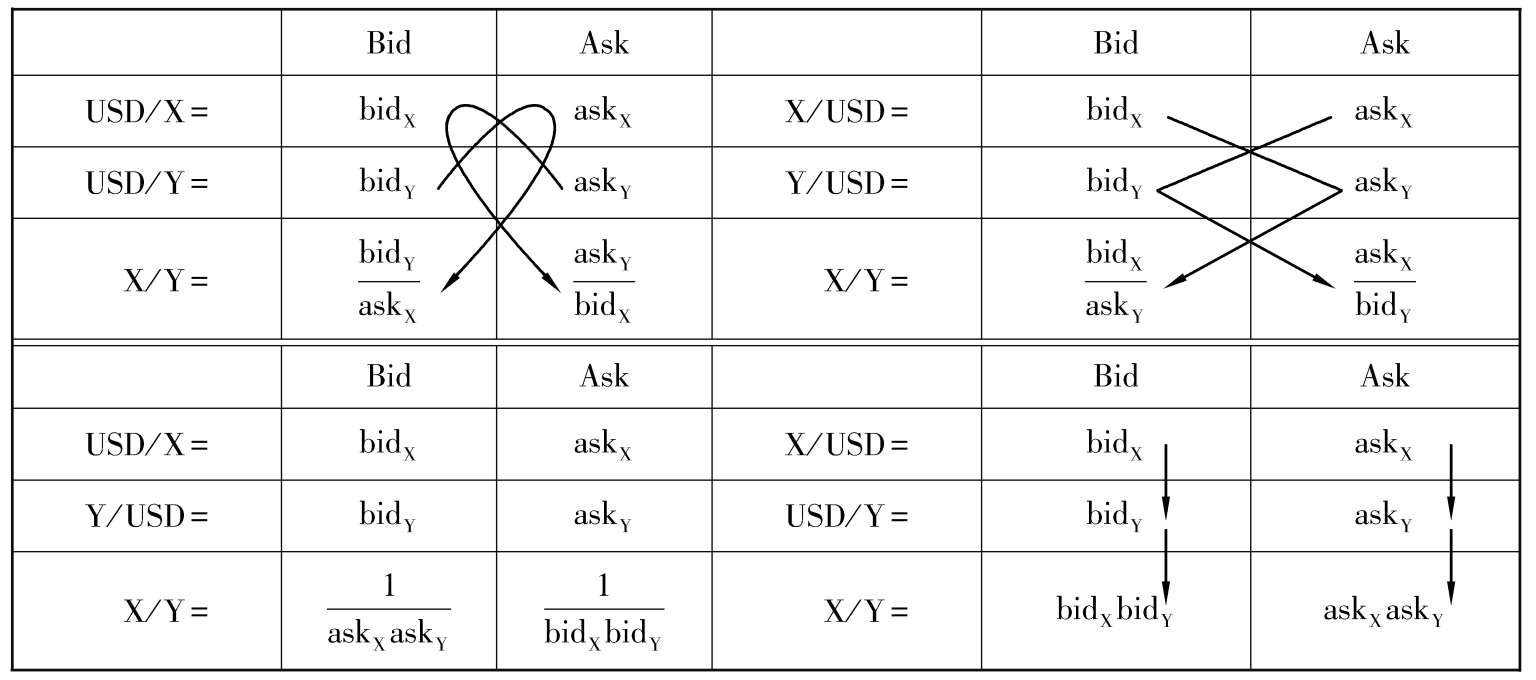

If bid and ask were taken into account to derive cross rates for currency pair that does not include USD,there are 3 situations.

1) Both Currency Pairs Have USD as Base Currency ( European Terms )

To derive cross rate from two European term currency pairs one should divide the quote currency by the base currency on the opposite side.The new bid rate is obtained through dividing the quote currency bid with the base currency ask;while the new ask rate is obtained by dividing the quote currency ask with the base currency bid.

For example,Given USD/JPY=113.85 /99 and USD/CAD=1.3368 /79,solve for bid and ask of CAD/JPY.

In new currency pair CAD/JPY,base currency is CAD,quote currency is JPY,then the CAD/JPY bid =113.85÷1.3379=85.096,which is the rate market maker buys CAD and sells JPY;the CAD/JPY ask =113.99÷1.3368=85.271,which is the rate market maker sells CAD and buys JPY.

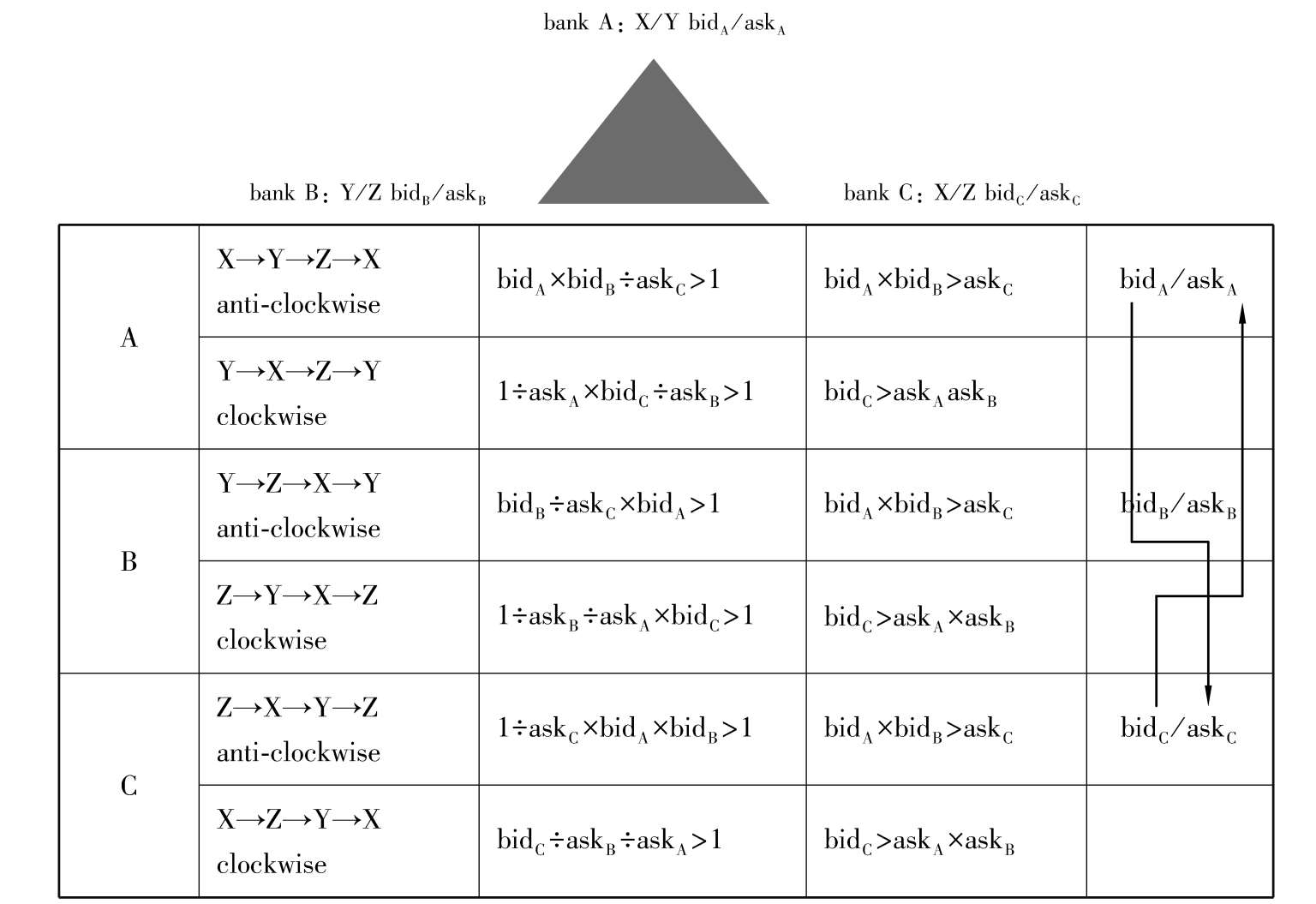

If generalized into currency X,Y,and USD,given USD/X=bid X /ask X and USD/Y=bid Y /ask Y ,to achieve bid and ask of X/Y,trader should go through the following process:

Bid price of X/Y is the price that bank(market maker)buys currency X from this individual trader,i.e.the price with which this individual trader sells currency X to bank.She first needs to sell X to bank for USD,the price she could get is ask X .For each X she sells,she gets 1÷ask X dollars.She then uses dollar to buy Y from bank.The price she could have is bid Y .Eventually,each X this individual trader sells to bank,i.e.each X bank buys from individual trader gives the rate as bid price of X/Y=bid Y ÷ask X .

If start with 1X→$(1÷ask X )→end with(bid Y ÷ask X )Y,then 1X=(bid Y ÷ask X )Y is the bid price of currency pair X/Y.

Ask price of X/Y is the price that bank sells currency X to this individual trader,i.e.the price with which this individual trader buys currency X from bank.She first needs to sell Y for USD,the price she could get is ask Y ,that is for each Y she sells,she gets 1÷ask Y dollars.She then uses dollar to buy X from bank.The price she could have is bid X .In conclusion,she starts with 1 unit of Y and ends with bid X ÷ask Y units of X.Each X this individual trader buys from bank,i.e.each X bank sells to this individual trader is the ask price of X/Y=1÷(bid X ÷ask Y )=ask Y ÷bid X .

If start with 1Y→$(1÷ask Y )→end with(bid X ÷ask Y )X,then 1X=1÷(bid X ÷ask Y )Y=(ask Y ÷bid X )Y is the ask price.

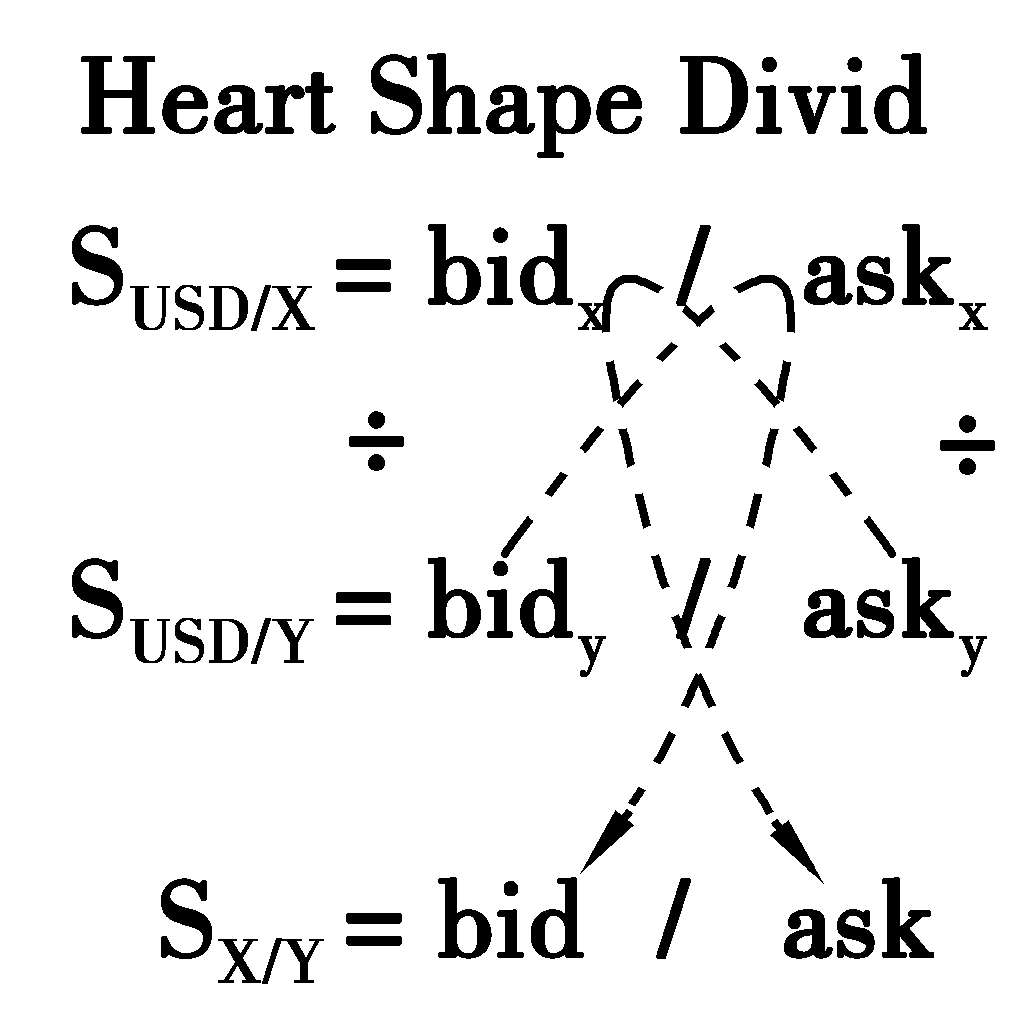

The following figure gives a summary of the method to calculate the cross-rate for two sided quotes when both currencies are quoted in European terms.The deriving process form as heart shape.

2) One of the Pairs Has USD as Quote Currency

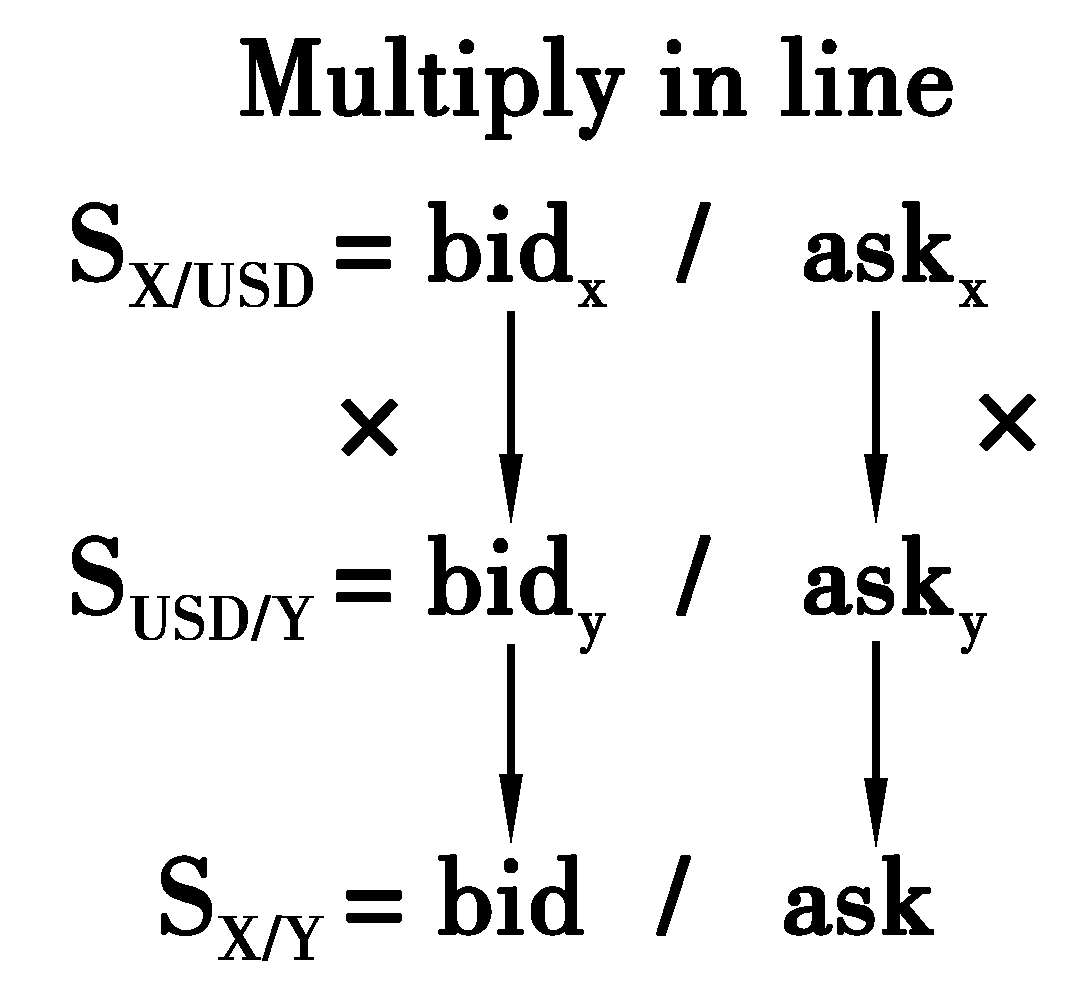

To derive cross rate from currency pairs with one has USD as quote currency is to multiply on the same side.The new bid rate is calculated by multiplying the quote currency bid by the base currency bid;and the new ask rate is calculated by multiplying the quote currency ask by the base currency ask.

(1)Given X/USD(American term)and USD/Y(European term),solve for X/Y

For example,GBP /USD=1.2285 /96 and USD/MXN=19.487 /93,solve for bid and ask of GBP /MNX.

In new currency pair GBP /MNX,base currency is GBP,quote currency is MNX.The bid price GBP /MNX bid =19.487×1.2285=23.94,is the rate bank(as the market maker)buys GBP and sells MNX;the GBP /MNX ask =19.493×1.2296=23.97,is the rate bank sells GBP and buys MNX.

To generalized the above calculation,suppose that quotations of X,Y and USD are given as X/USD=bid X /ask X and USD/Y=bid Y /ask Y ,to achieve bid and ask for X/Y,an individual trader goes through the following process:

Bid price of X/Y is the price that bank buys currency X from this individual trader,i.e.the price with which this individual trader sells currency X to bank.She first needs to sell X for USD,the price she could get is bid X .For each X she sells,she gets bid X units of dollars.She then use dollar to buy Y from bank.The price she could have is bid Y .Each X this individual trader sells to bank,i.e.each X bank buys from individual trader follows the rate as bid price of X/Y=bid X ×bid Y .

If start with 1X→$bid X →end with(bid X ×bid Y )Y,then 1X=(bid X ×bid Y )Y is the bid price.

Ask price of X/Y is the price that bank sells currency X to this individual trader,i.e.the price with which this individual trader buys currency X from bank.She first needs to sell Y for USD,the price she could get is ask Y .For each Y she sells,she gets 1÷ask Y dollars.She then uses dollar to buy X from bank.The price she could have is ask X .She starts with 1 unit of Y and ends with 1÷(ask X ×ask Y )units of X;each X this individual trader buys from bank,i.e.each X bank sells to this individual trader is ask price of X/Y=ask X ×ask Y .

If start with 1Y→$(1÷ask Y )→end with 1÷(ask X ×ask Y )X,then 1X=(ask X ×ask Y )Y is the ask price.

(2)Given USD/X(European term)and Y/USD(American term),solve for X/Y

If quotations of X,Y and USD are given as USD/X=bid X /ask X and Y/USD=bid Y /ask Y ,to achieve bid and ask for X/Y,an individual trader goes through the following process:

Bid price of X/Y is the price that bank buys currency X from this individual trader,i.e.the price with which this individual trader sells currency X to bank.She first needs to sell X for USD,the price she could get is ask X ,that is for each X she sells,she gets 1÷ask X dollars.She then uses dollar to buy Y from bank.The price she could have is ask Y .Each X this individual trader sells to bank,i.e.each X bank buys from individual trader follows the rate as bid price of X/Y=1÷(ask X ×ask Y ).

If start with 1X→$(1÷ask X )→end with 1÷(ask X ×ask Y )Y,then 1X=1÷(ask X ×ask Y )Y is the bid price.

Ask price of X/Y is the price that bank sells currency X to this individual trader,i.e.the price with which this individual trader buys currency X from bank.She first needs to sell Y for USD,the price she could get is bid Y ,that is,for each Y she sells,she gets bid Y dollars.She then uses dollar to buy X from bank.The price she could have is bid X .She starts with 1 unit of Y and ends with bid X ×bid Y units of X;each X this individual trader buys from bank,i.e.each X bank sells to this individual trader follows the rate as ask price of X/Y=1÷(bid X ×bid Y ).

If start with 1Y→$bid Y →end with(bid X ×bid Y )X,then 1X=1÷(bid X ×bid Y )Y is the ask price.

It is usually to quote cross-currency exchange rates using the “heavier” currency as the base,for example,the number of yen per dollar.For currencies like the euro and sterling,it is market practice to multiply the respective currencies against each other.For example,consider the following:

USD/JPY=107.32 /37

GBP /USD=1.4231 /38

Between sterling and yen,the heavier currency is sterling,then the sterling against yen spot cross rate calculation will be GBP /JPY=107.32×1.4231 /107.37×1.4238=152.73 /87.

For two currencies as demenstrated in the following figure,one quoted in European terms and the other in American terms,the bid rate of the cross-rate is the product of the two spot bids,and the cross-rate ask is the product of the two spot asks,with the American-quoted currency as the unit of account.

3) Both Pairs Have USD as Quote Currency ( American Term )

To achieve the cross rate from two American term currency pairs one should divide the base currency by the quote currency on opposite side.The new bid rate is achieved by dividing the base currency bid by the quote currency ask;while the new ask rate is obtained by dividing the base currency ask by the quote currency bid.

For example,given GBP /USD=1.2285 /96 and EUR/USD=1.0615 /21,solve for bid and ask of EUR/GBP.

In new currency pair EUR/GBP,base currency is EUR,quote currency is GBP,then the EUR/GBP bid =1.0615÷1.2296=0.8633,which is the rate bank buys EUR and sells GBP;the EUR/GBP ask =1.0621÷1.2285=0.8646,which is the rate bank sells EUR and buys GBP.

If generalized into currency X,Y,and USD,given X/USD=bid X /ask X and Y/USD=bid Y /ask Y ,to achieve bid and ask for X/Y,an individual trader goes through the following process:

Bid price of X/Y is the price that bank buys currency X from this individual trader,i.e.the price with which this individual trader sells currency X to bank.She first needs to sell X for USD,the price she could get is bid X ;that is,for each X she sells,she gets bid X dollars.She then uses dollar to buy Y from bank.The price she could have is ask Y .Each X this individual trader sells to bank,i.e.each X bank buys from individual trader follows the rate as bid price of X/Y=bid X ÷ask Y .

If start with 1X→$bid X →end with(bid X ÷ask Y )Y,then 1X=(bid X ÷ask Y )Y is the bid price.

Ask price of X/Y is the price that bank sells currency X to this individual trader,i.e.the price with which this individual trader buys currency X from bank. S he first needs to sell Y for USD,the price she could get is bid Y ;i.e,for each Y she sells,she gets bid Y dollars.She then uses dollar to buy X from bank.The price she could have is ask X .She starts with 1 unit of Y and ends with bid Y ÷ask X units of X;each X this individual trader buys from bank,i.e.each X bank sells to this individual trader follows the rate as ask price of X/Y=1÷(bid Y ÷ask X )=ask X ÷bid Y .

If start with 1Y→$bid Y →end with(bid Y ÷ask X )X,then 1X=1÷(bid Y ÷ask X )Y=(ask X ÷bid Y )Y is the ask price.

The following figure pictures the way to calculate the cross rate with two sided quotes when both currencies are quoted in American terms.

A summary about rules to derive spot cross rate is provided as follows:

Table 3-5 Cross Rate

The difference between bid and ask prices is referred to as the “spread”.Market makers usually quote bid-ask spread in percentage terms.It is customarily calculated as a percentage of ask price:spread=

×100%.

×100%.

Individual traders in FX market may have many choices for the same currency pair,and can choose the offer with the most beneficial spreads.They shop around for the best spreads,choosing the highest bid rate and the lowest ask rate.Generally,the wider the spread the more expensive it is for an individual trader,whereas the thinner the spread the cheaper.

Market makers consider the following 4 main factors to offer bid-ask prices:

• Inventory holding costs;

• Currency pair's liquidity or trading volume;

• Exchange rate volatility(market uncertainty);

• Number of dealers(market competition).

1) Inventory Holding Cost

Bid-ask spread must cover market makers' costs,such as phone bills,internet charges,employees' salary and bookkeeping charges,as well as their potential profit.

The inventory holding cost is to compensate the opportunity cost a dealer has to forgo for holding one specific currency or the potential loss that the inventory currency value will change adversely.

Take currency pair GBP /USD for instance,if a dealer forecasts that GBP will depreciate against USD,it will enlarge bid-ask spread to compensate the opportunity cost for holding GBP instead of holding USD.Particularly,it would increase spread by lowering bid price down,which would discourage traders to sell GBP to this dealer and reduce GBP inventory.

If a dealer has an overly large position in a currency relative to the desired net position,the dealer will alter the midpoint of the spread rather than adjust the spread.If one dealer has a serious shortage of one currency,she will move the midpoint of the direct quote up;if one intends to reduce one currency inventory,she cuts the midpoint of the direct quote down.

2) Currency Pair ’ s Liquidity or Trading Volume

Market makers' costs are largely fixed,therefore their contribution to the size of the bid-ask spread fall with trading volume,i.e.the higher the trading volume,the lower the bid-ask spread.Large and frequently traded currencies usually offer a small bid-ask spread while small and infrequently used currencies have a large bid-ask spread.

The most frequently traded currency pairs generally have the narrowest spreads,as long as no major fluctuations are seen in a country's supply and demand.High liquidity narrows the spread.It is because most frequently traded currency pairs have lower volume-adjusted transaction costs;while least frequently traded currency pairs incur higher volume-adjusted transaction costs.If there is an imbalance in the supply and demand of a country's currency then the bid-ask spread will widen.The higher the volume,the lower the bid-ask spread;or the more active a market,the lower the bid-ask spread.

3) Exchange Rate Volatility ( Market Uncertainty )

Risks such as political instability,high inflation and changing economic conditions would contribute to uncertainty.One of criteria to measure the risks is the exchange rate volatility.The higher the uncertainty,the higher volatility.In order to cover risks,currency dealers or market makers increase the spread

.

.

4) Number of Dealers ( Market Competition )

Market makers or exchange dealers gain market share by narrowing spread down.The more fierce the competition is,the narrower the bid-ask spread is

.If there is barriers to entry in the market,spread would be wider;when competition increases,the bid-ask spread approaches the expected marginal cost of supplying liquidity.

.If there is barriers to entry in the market,spread would be wider;when competition increases,the bid-ask spread approaches the expected marginal cost of supplying liquidity.

The before mentioned factors are main bid-ask spread determinations.Besides those,spreads are also affected by the size of the transaction

,time of the trading in the day

,time of the trading in the day

,order placement strategy

,order placement strategy

,adverse selection

,adverse selection

,etc.

,etc.

When analysis exchange rate movements,mid-rate is applied.Mid-rate is the sum of bid and ask divided by 2:mid-rate=

.

.

A very important mid-rate in China's foreign exchange market is CNY central parity rate.The China Foreign Exchange Trade System(CFETS),authorized by the People's Bank of China,calculates and publishes the central parity of CNY against USD and other 23 major foreign currencies on each business day.

One can check CNY central parity rates through http://www.chinamoney.com.cn /english /.Since Jan.4,2006,the People's Bank of China has authorized the CFETS to announce the daily central parity of the CNY exchange rate against USD,EUR,JPY and the Hong Kong dollar HKD on each trading day,which is considered the central parity of the exchange rate for the interbank foreign exchange spot market(including OTC transactions and auto-matching transactions)and for retail market on that day.

The exchange rate of the CNY against GBP announced on 1st Aug.2006.

The exchange rate of the CNY against MYR announced on 19th Aug.2010.

The exchange rate of the CNY against the RUB announced on 22ed Nov.2010.

The exchange rate of the CNY against the AUD and the CAD announced on 28th Nov.2011.

The exchange rate of the CNY against the NZD announced on 19th Mar.2014.

The exchange rate of the CNY against the SGD announced on 28th Oct.2014.

The exchange rate of the CNY against the CHF announced on 10th Nov.2015.

The exchange rate of the CNY against the ZAR announced on 20th Jun.2016.

The exchange rate of the CNY against the KRW announced on 27th Jun.2016.

The exchange rate of the CNY against the AED,SAR announced on 26th Sep.2016.

The exchange rate of the CNY against the HUF、PLN、DKK、SEK、NOK、TRY、MXN announced on 12th Dec.2016.

On 5th Feb.2018 the exchange rate of CNY against THB was announced.

The CNY extended its slide on 12th Sep.2017 after China's central bank lowered the mid-rate around which the currency can trade against USD since Jan.2017.

The decline followed the Chinese currency's challenging day in three months on 11th Sep.2017 after the People's Bank of China on 8th Sep.2017 dropped a requirement raising the cost of betting on CNY depreciation,and scrapped a requirement that banks hold reserves against CNY deposits held in Hong Kong and other offshore centers.

On 12th Sep.2017 the PBOC set the daily fix—the mid-rate around which the CNY can trade 2% in either direction against the dollar—at CNY 6.5277,which was 0.4% softer than the previous day and the most significant weakening since 9th Jan.2017.

That prompted the onshore exchange rate for the CNY to weaken as much as 0.3% to CNY 6.548 against the dollar,bringing it down a cumulative 1.7% from 8th Sep.2017's peak.

The offshore rate,which is not bound by the PBOC band,eased as much as 0.2% to CNY 6.5518 per dollar.

The central parity of CNY against USD is determined in the following way:The CFETS first inquires prices from all market makers before the opening of the market on each business day.Market makers should refer to the closing rate of the inter-bank foreign exchange market on the previous day,in conjunction with demand and supply condition in the foreign exchange market and exchange rate movement of the major currencies.CFETS excludes the highest and lowest offers,and then calculates the weighted average of the remaining prices in the sample as the central parity of CNY against USD for the day.The weights are determined by the CFETS in line with the transaction volumes of the respective market makers in the market as well as other indicators such as the performance of market-making.

The central parity of CNY against HKD and CAD are calculated by counting the cross rates between the CNY central parity and the exchange rates of USD against HKD and CAD quoted at international FX market at 9:00 am,respectively.

The central parity of CNY against EUR,JPY,GBP,AUD,NZD,SGD,CHF,MYR,RUB,ZAR and KRW are determined in the following way:the CFETS inquires prices from market makers for EUR,JPY,GBP,AUD,NZD,SGD,CHF,MYR,RUB,ZAR and KRW respectively before the opening of the foreign exchange market on each business day,and calculates the average of the prices as the central parity of CNY against EUR,JPY,GBP,AUD,NZD,SGD,CHF,MYR,RUB,ZAR and KRW for the day.

In total,there are 23 CNY central parity rates provided,including 21 direct trading currencies and HKD and USD.

Because the inclusion of the Chinese currency in the Special Drawing Right(SDR)basket would require a market-based CNY/USD “reference” rate,which will serve as the pricing standard for the SDR,as well as in order to better facilitate CNY/FX pricing and trading and provide more market-based exchange rate references for the market players,CFETS has started to publish the reference rates of CNY against USD and other major foreign currencies according to market requirements on each trading day since 24th Aug.2015 on www.chinamoney.com.cn.The adopted calculation method is by taking the weighted average of the market dealt prices within 30 seconds before each time point respectively.The reference rates of all the time points are based on the domestic interbank FX market dealt prices and are a comprehensive reflection of FX market supply and demand on the due trading day.The USD/CNY reference rates is updated 5 time each day:10:00,11:00,14:00,15:00,16:00.Following USD/CNY pair,CFETS published seven more reference rates at 17:00,18:00,19:00,20:00,21:00,22:00 and 23:00 since the extension of trading time of China interbank FX market on Jan.1,2016.

CFETS has started to publish the EUR/CNY,JPY/CNY and GBP /CNY reference rates since 25th Aug.2016,including reference rates at 11:00 and 15:00.