投资环境正在发生变化,女性正在引领潮流。

测试中可能遇到的词汇和知识:

grill [ɡrɪl] v.拷问

elite [eɪˈliːt] n.精英

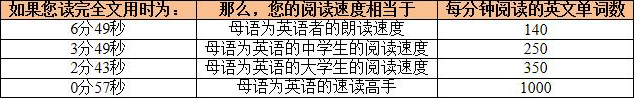

阅读马上开始,建议您计算一下阅读整篇文章所用的时间,对照下方的参考值就可以评估出您的英文阅读水平。

Greta Thunberg, the 16-year-old schoolgirl superstar of the climate change movement, took a 32-hour train ride from Sweden to the World Economic Forum last month to meet — and grill — the Davos elite.

Unlike many of them, she did not arrive by private jet. She blamed them for focusing on profits at the expense of preserving the environment. Her message inspired children in many countries to stand up in the fight against climate change, and she also inspired me.

While most of us aren’t taking the fight to global leadership conferences, networking technologies increasingly allow us to publicise and tackle important issues in a way that gains traction. The impact punches through to the corporate world and thus the investment arena.

Electric car sales are soaring; veganism is on the rise; a consumer boycott of milk products severely affected Danone’s quarterly earnings. People see that we can all make an impact with the way we spend money. But what about through how we invest?

Climate change and sustainability are themes that female investors find highly engaging. According to Morgan Stanley, 84 per cent of women say they are interested in investing for impact and sustainability, versus 67 per cent of men. This tallies with the rise of environmental, social and governance (ESG) investing. But this ethos isn’t necessarily applied to the investments women make in the traditional sense of the word.

Women reinvest 90 per cent of their earnings back into their families and communities, focusing on education and health in particular, according to research by the World Bank presented at the World Economic Forum.

The theme of International Women’s Day this year is #BalanceforBetter — the better the balance, the better the world. If there’s one place I would wish to see greater gender balance, it would be in financial services.

In the UK, the financial services industry has one of the largest gender pay gaps. Although more women are getting to the top of the industry, the services and products that the industry produces are still largely tailored to a male clientele.

How do I know this? Through meeting female investors at the events run by my own start-up, Vestpod.

Our mission is to empower women financially. As well as providing a “safe place” for women to talk about their financial goals and meet like-minded female investors, the topics women tell us they want to learn more about show their desire to do things differently — and importantly, make a difference.

Women I talked to at an event last month were seeking to make an impact with their investments, ready to combine their conscience with financial firepower. But they were finding it hard to find these kinds of investment opportunities.

Should we therefore be surprised that more women are choosing to invest their own money into starting their own businesses?

Women are also founding companies at a historically high rate, creating jobs and personally driving the impact they want to see.

Women founders increasingly look beyond traditional ways of working. At the same time, they see market opportunities for products and services that don’t yet exist, or where today’s solutions don’t suit their needs.

This pays off. A study by Boston Consulting Group (BCG) found that female-led businesses are becoming sought-after investments. Two great examples are direct-to-consumer beauty company Glossier, which has so far raised more than $86m, and the women-only co-working space The Wing, which has raised nearly $120m to date.

Research by Ian Hathaway, who leads the Center for American Entrepreneurship, shows that the number of female founders raising money from venture capital first financings tripled from 7 to 21 per cent between 2005 and 2017. However, the overall share of venture capital funding going to all-female-led businesses is still low at just over 2 per cent.

For women, investing in female-led businesses is another hot topic. Writing in the FT this week, the entrepreneur Emma Sinclair revealed how the tech company she co-founded, EnterpriseAlumni, deliberately targeted a 50:50 gender split in its latest funding round. It succeeded, with equal numbers of male and female shareholders.

Women are more likely to focus on specific outcomes and goals when saving and investing, while men tend to focus on products and investment outcome

Emilie Bellet

Ms Sinclair says was driven to act by the lack of diversity in the tech sector. “Everyone told us we were mad; women don’t invest; it was a poor use of our time when one fund could write a cheque,” she says. But she took the Nike advert narrated by Serena Williams to heart: “If they want to call you crazy, show them what crazy can do.”

Women running their own companies and taking more executive decision-making roles will have an impact in its own right. But so will women’s growing personal wealth.

According to BCG, women’s private wealth is expected to be more than 30 per cent of total wealth by 2020. Women are controlling more money, whether they earn it, manage it for their household, or inherit it. More women are starting to out-earn their partners or become the main breadwinner.

At Vestpod, we know that women have a different approach to wealth building. Women are more likely to focus on specific outcomes and goals when saving and investing, while men tend to focus on products and investment outcome.

But wealth is not just about money. It’s about the impact it can have on our families, society and our planet. Increasingly, women hold the power to change the world by leveraging their wealth. In the search for #BalanceforBetter the financial services companies need to recognise this.

Emilie Bellet is the founder of Vestpod.com and her first book ‘You’re Not Broke, You’re Pre Rich’ will be published in May Twitter: @emilieldn

请根据你所读到的文章内容,完成以下自测题目:

A.Envy

B.Admiration

C.Disgust

D.Sympathy

答案 (1)

A.Wealth is not just about money.

B.Wealth is all about money.

C.Wealth has nothing about money.

D.Wealth has no relationship with money.

答案 (2)

A.Report a new event

B.Analyze a complex investment strategy

C.Shed light on a scientific discovery

D.Call for attention and action

答案 (3)

(1) 答案:C. Disgust解释:Greta Thunberg, the 16-year-old schoolgirl superstar of the climate change movement, took a 32-hour train ride from Sweden to the World Economic Forum last month to meet — and grill — the Davos elite.

(2) 答案:A. Wealth is not just about money.解释:But wealth is not just about money. It’s about the impact it can have on our families, society and our planet.

(3) 答案:D Call for attention and action