上个月近三年来中国工业企业的利润首次下降,这是消费疲软和基础设施投资不足导致经济放缓的最新迹象。

测试中可能遇到的词汇和知识:

flagging['flægɪŋ] adj.疲软的

capex abbr.资本支出

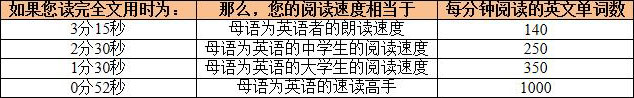

阅读马上开始,建议您计算一下阅读整篇文章所用的时间,对照下方的参考值就可以评估出您的英文阅读水平。

-----------------------------------------------------

Profits fell at Chinese industrial companies for the first time in nearly three years last month, in the latest sign of an economic slowdown from weak consumption and flagging infrastructure investment.

Chinese policymakers last week announced their intention to enact fresh fiscal and monetary stimulus measures, in a bid to mitigate against a weakening economy and the threat by Donald Trump to raise levies on $200bn worth of goods to 25 per cent.

Thursday’s data showed industrial profits declined 1.8 per cent in November from a year earlier, the first negative reading since December 2015 and a steep fall from 3.6 per cent growth in October. Goldman Sachs estimated that profits fell even more sharply on a seasonally adjusted basis, down from 7.2 per cent from October.

Analysts said that the profit slowdown partly reflected businesses pulling back on investment in anticipation of the weaker domestic and external demand. “We have already witnessed a sharp pullback of upstream manufacturing capex,” Charles Yue Yuan, an economist at China International Capital Corporation, wrote on Thursday.

He added that slower credit growth resulting from China’s debt-cutting campaign has caused low inflation, leading to weak nominal profit growth at industrial groups. “This trend (of slow credit growth), if left unadjusted, will probably result in further deterioration of corporate profitability and economic fundamentals,” Mr Yuan wrote.

The release of the official data came as China’s internet regulator announced tighter controls on financial information providers who, the regulator warned, could disrupt market stability by publishing sensitive material.

The government has already tightened censorship of negative economic information from news outlets, think-tanks and sellside research analysts. The latest rules from the Cyberspace Administration of China target financial information and database providers, consultancies and stock exchanges.

“Some institutions fail to check information strictly, hype up financial risk, publish sensitive market information, distort financial regulatory policy, and seriously affect economic and financial stability, requiring urgent disciplinary action,” the agency said in a statement.

While China’s propaganda authorities have long maintained strict control of print, broadcast and online news media, financial information and database providers have operated in a regulatory grey zone.

Domestic financial terminal providers such as Wind and Choice compete with Bloomberg and Thomson Reuters. Some effectively publish news but are not regulated as news organisations. The new rules state that any institution publishing news should obtain a licence.

Authorities have appeared increasingly sensitive to negative economic information and rumours. Last week, China’s top financial regulatory body issued an unusual one-line statement denying rumours that China’s annual economic policy planning meeting — scheduled to conclude later that day — would not announce new tax cuts.

The national statistics agency this month forced Guangdong province, the southern export hub, to stop publishing its monthly purchasing managers’ index, a closely watched gauge of manufacturing activity and sentiment.

The Financial Times reported in November that propaganda authorities had extended censorshipcontrols traditionally reserved for political news to encompass economic reporting.

Also last month, the chief securities regulator instructed a meeting of chief economists from top securities brokerages that they should support Communist party policies and “contribute positive energy to guiding market expectations”, according to the state-controlled Securities Association of China.

请根据你所读到的文章内容,完成以下自测题目:

A.Present an in-depth analysis to an event which happened two years ago.

B.Report a news event and explain some background.

C.Explain a newly discovered economic theory.

D.Urge policy makers to do the right thing.

答案 (1)

A.Economic imbalance

B.Economic pickup

C.Economic slowdown

D.Economic overheating

答案 (2)

A.Anticipation of the weaker domestic and external demand

B.Goldman Sachs' estimation

C.China's fiscal and monetary stimulus measures

D.Faster credit growth

答案 (3)

A.Sensitive

B.Optimistic

C.Indifferent

D.Supportive

答案 (4)

(1) 答案:B解释:This is a news article.

(2) 答案:C解释:Profits fell at Chinese industrial companies for the first time in nearly three years last month, in the latest sign of an economic slowdown from weak consumption and flagging infrastructure investment.

(3) 答案:A解释:Analysts said that the profit slowdown partly reflected businesses pulling back on investment in anticipation of the weaker domestic and external demand.

(4) 答案:A解释:Authorities have appeared increasingly sensitive to negative economic information and rumours.