“双层爱尔兰”(double Irish)是最近处在风口浪尖的一个话题,美国企业在爱尔兰的避税数额巨大,欧盟和美国政府都摩拳擦掌想要关闭各种税收漏洞。这篇Q&A为你解释这一切。

测试中可能遇到的词汇和知识:

pharmaceutical [,fɑːmə'suːtɪk(ə)l; -'sjuː-] 制药的

Bermuda [bə'mju:də] 百慕大,大西洋上的英国海外领土,世界知名离岸金融中心

royalty ['rɒɪəltɪ] 版税,专利权

state aid 政府补贴

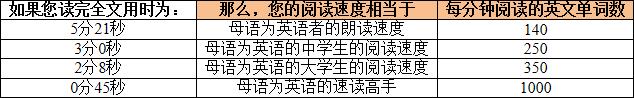

阅读马上开始,建议您计算一下阅读整篇文章所用的时间,对照下方的参考值就可以评估出您的英文阅读水平。

The European Commission has threatened to launch a formal investigation into a vital aspect of Ireland's tax system, known as the “double Irish”. This is a simple structure used by US technology and pharmaceutical companies to route profits to tax havens like Bermuda where they hold intellectual property.

How does the double Irish work?

The double Irish exploits the different definitions of corporate residency in Ireland and the US. Dublin taxes companies if they are controlled and managed in Ireland, while the US' definition of tax residency is based on where a corporation is registered. Companies exploiting the double Irish put their intellectual property into an Irish-registered company that is controlled from a tax haven such as Bermuda. Ireland considers the company to be tax-resident in Bermuda, while the US considers it to be tax-resident in Ireland. The result is that when royalty payments are sent to the company, they go untaxed - unless or until the money is eventually sent home to the US parent company.

Why is it so controversial?

The double Irish and similar structures have allowed US multinationals to park about $1tn of cash in tax havens. That causes frustration for the US Treasury which cannot tax companies' worldwide profits until they are repatriated to the US. It also annoys governments in the countries outside the US where these corporations do business. The ability to send profits to a tax haven has given companies an incentive to report as little profit as they can in the countries where they operate.

What do the companies say?

In their defence, US companies view it as a kind of self-help measure that allows them to compete internationally despite the US's relatively high tax rate on worldwide profits. The companies also stress they are playing by the rules that are set by governments. When politicians attacked Google over its overseas tax rate of just 3.2 per cent in 2011, Eric Schmidt, executive chairman, said the tax structure was “based on the incentives that the governments offered us to operate”.

Google employs thousands of people from dozens of countries in Dublin's former docklands, although Ireland only taxes a sliver of profit from Google's overseas sales which are booked in the country. The technology giant justifies shifting billions of dollars away from Ireland to Bermuda using a double Irish structure on the ground that its profits largely arise from the intellectual property generated in the US.

Can Brussels attack the structure?

To show the double Irish breached state aid rules, Brussels would need to show that it gave a selective advantage to certain types of companies, in this case US multinationals. It might be quite tricky to prove but the uncertainty would create a huge headache for business and tarnish Ireland's low-tax brand. The structure's days are generally thought to be numbered anyway, as a result of a planned overhaul of global tax rules initiated by G20 countries.

What would it mean for business?

A successful challenge under the State Aid rules could potentially force companies to pay billions of dollars of extra tax. Even if the double Irish was simply abolished, it would lead to a hike in tax rates and a dent in profits. Although US tax is only deferred – rather than avoided – on the money parked in tax havens, companies usually do not account for the US tax they may ultimately have to pay.

Technology companies are often valued on their growth prospects rather than their earnings but even so, there will be a reluctance to abandon the very low foreign rates – in single digits – generated by the double Irish. So if Ireland closes the structure, the search will be on for other loopholes across the world that have escaped the crackdown. That is why Ireland is so queasy about the prospect of axing the double Irish before other countries have made changes, particularly if it cannot phase in the changes over several years.

So Ireland will get rid of the double Irish in the end?

There is a global consensus that routing profits to tax havens should be stopped. When that happens, many experts think that Ireland can block the use of the structure without too many ill effects. Both technology and pharmaceutical corporations have invested heavily in Ireland, so an exodus is unlikely. And low-tax Ireland is well-placed to compete under planned new global tax rules that will require companies to be taxed where they actually operate.

请根据你所读到的文章内容,完成以下自测题目:

A.They enjoy favorable tax rates in Ireland.

B.They have comparative advantage in world trade.

C.Revenues from intellectual property can escape to Bermuda.

D.They can reinvest profits in Europe instead of wiring them back to US.

答案 (1)

A.$1 trillion in cash accumulated.

B.$1 trillion from Ireland to Bermuda alone.

C.3.2% of US treasury revenue.

答案 (2)

A.Report as little royalty payments as possible.

B.Report as few assets in Ireland as possible.

C.Report as little profit as possible.

答案 (3)

A.Brussels would close all kinds of tax loopholes.

B.Irish economy would suffer as multinationals going away.

C.Dublin would have to lift tax rates to compensate its losses.

D.Competitiveness of high-tech firms wouldn't be hurt much.

答案 (4)

(1) 答案:C.Revenues from intellectual property can escape to Bermuda.解释:第一个问题解释了这种避税方式,高科技企业可以利用“双层爱尔兰结构”避税。

(2) 答案:A.$1 trillion in cash accumulated.解释:The double Irish and similar structures have allowed US multinationals to park about $1tn of cash in tax havens. 双层爱尔兰和类似的结构让美国跨国企业将1万亿美元现金放在避税天堂。

(3) 答案:C.Report as little profit as possible.解释:按照前两个问题的回答,美国企业在爱尔兰的知识产权收入可以避税(送到百慕大),因此他们就有动力少报公司所得、少交公司所得税率,将利润以知识产权收入的形式进行避税。

(4) 答案:D.Competitiveness of high-tech firms wouldn't be hurt much.解释:由于而爱尔兰的税率等优势本来就很大,很多专家认为,就算政府关闭双层结构,也不会有很大负面影响,何况高科技企业还有其他避税手段可用。对爱尔兰来说,外企大量撤出并不现实。10月15日,爱尔兰政府果然封堵了这个漏洞,它表示,2015年新设的公司不得再采用双层结构,现有的企业必须在2020年前退出。